Broker Mortgage Fees - An Overview

Wiki Article

Getting The Broker Mortgage Calculator To Work

Table of ContentsHow Broker Mortgage Near Me can Save You Time, Stress, and Money.Broker Mortgage Meaning - An OverviewAbout Mortgage Broker AssistantGetting The Mortgage Broker Meaning To WorkLittle Known Facts About Mortgage Brokerage.The Ultimate Guide To Mortgage BrokerThe Greatest Guide To Mortgage BrokerageThe Main Principles Of Broker Mortgage Meaning

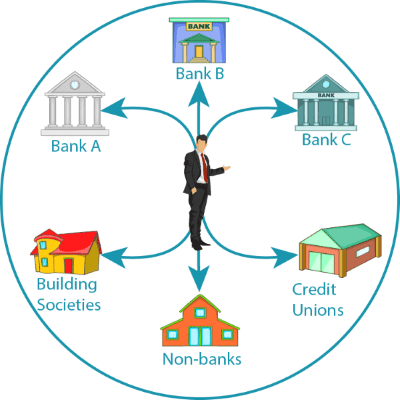

A broker can contrast lendings from a financial institution and a lending institution, for instance. A banker can not. Lender Income A home loan lender is paid by the organization, typically on an income, although some organizations offer financial motivations or incentives for efficiency. According to , her initial obligation is to the establishment, to ensure loans are effectively safeguarded and also the consumer is completely qualified and will make the financing payments.Broker Commission A mortgage broker stands for the customer more than the lender. His obligation is to obtain the borrower the finest deal feasible, regardless of the institution. He is usually paid by the funding, a sort of payment, the difference in between the rate he obtains from the borrowing institution and also the rate he provides to the debtor.

The 5-Minute Rule for Mortgage Broker Average Salary

Jobs Defined Understanding the pros and disadvantages of each could aid you decide which career path you wish to take. According to, the main difference between the two is that the bank mortgage policeman stands for the items that the bank they help offers, while a mortgage broker functions with numerous lenders as well as serves as an intermediary in between the loan providers as well as client.On the various other hand, financial institution brokers may find the work ordinary after a while considering that the process generally remains the same.

Some Known Details About Mortgage Broker Vs Loan Officer

What Is a Financing Officer? You might understand that finding a car loan policeman is an essential step in the process of acquiring your funding. Allow's review what funding police officers do, what understanding they require to do their work well, and whether lending police officers are the very best choice for borrowers in the finance application screening process.

A Biased View of Mortgage Broker

What a Finance Police officer Does, A finance policeman helps a bank or independent lender to help consumers in applying for a loan. Because lots of consumers collaborate with lending police officers for home mortgages, they are frequently referred to as home mortgage finance officers, however several funding police officers assist customers with various other lendings too.If a funding policeman thinks you're qualified, then they'll advise you for authorization, and you'll be able to continue on in the procedure of obtaining your lending. What Loan Policemans Know, Lending policemans should be able to function with consumers as well as tiny service owners, as well as they have to have substantial expertise regarding the sector.

The smart Trick of Broker Mortgage Calculator That Nobody is Talking About

Just How Much a Financing Police Officer Prices, Some financing policemans are paid through commissions (mortgage broker vs loan officer). Home loan financings tend to result in the largest payments because of the size and workload associated with the finance, however payments are frequently a flexible pre-paid fee.Finance officers understand all concerning the lots of types of financings a lender might use, and also they can provide you advice about the finest option for you as well as your circumstance. Review your needs with your loan find here policeman.

The 4-Minute Rule for Broker Mortgage Rates

The Role of a Financing Policeman in the Screening Refine, Your loan officer is your straight get in touch with when you're using for a funding. You will not have to worry regarding consistently contacting all the people included in the home mortgage loan procedure, such as the expert, actual estate agent, negotiation attorney as well as others, since your car loan police officer will be the point of contact for all of the included celebrations.Since the process of a funding deal can be a complex and pricey one, several customers choose to deal with a human being as opposed to a computer system. This is why banks might have numerous branches they desire to serve the potential borrowers in numerous locations that want to fulfill face-to-face with a financing officer.

Some Known Questions About Mortgage Broker Association.

The Function of a Funding Officer in the Car Loan Application Refine, The home mortgage application process can feel overwhelming, especially for the first-time homebuyer. When you function with the right funding police officer, the procedure is actually quite basic.During the car loan handling phase, your loan policeman will contact you with any i thought about this type of inquiries the funding cpus may have about your application. Your funding policeman will certainly after that pass the application on the underwriter, that will certainly evaluate your credit reliability. If the expert authorizes your car loan, your financing policeman will then collect and also prepare the suitable funding shutting papers.

The Single Strategy To Use For Mortgage Broker Vs Loan Officer

So how do you select the ideal car loan officer for you? To start your search, begin with lending institutions who have a superb track record for exceeding their customers' expectations and also keeping market standards. Once you have actually selected a lending institution, you can then begin to tighten down your search by speaking official site with lending policemans you may wish to deal with (mortgage broker association).

Report this wiki page